Price can be used strategically, such as in helping to set your positioning, opening up new dayparts through loss-leader strategies, and dropping prices to prevent competitive intrusion.

Today, I want to focus on how I see restaurants setting prices for existing menus. Far too often, I hear about setting prices in relation to the competition, which strikes me as odd. Last I checked, your competition is not paying your bills.

Before I provide some alternatives, let me ask a couple of questions:

- When you focus on the competition in setting price—how do you know which competition on which to focus? Your competitive set is likely broader than what you are using.

- Does your competition have the same cost structure as you?

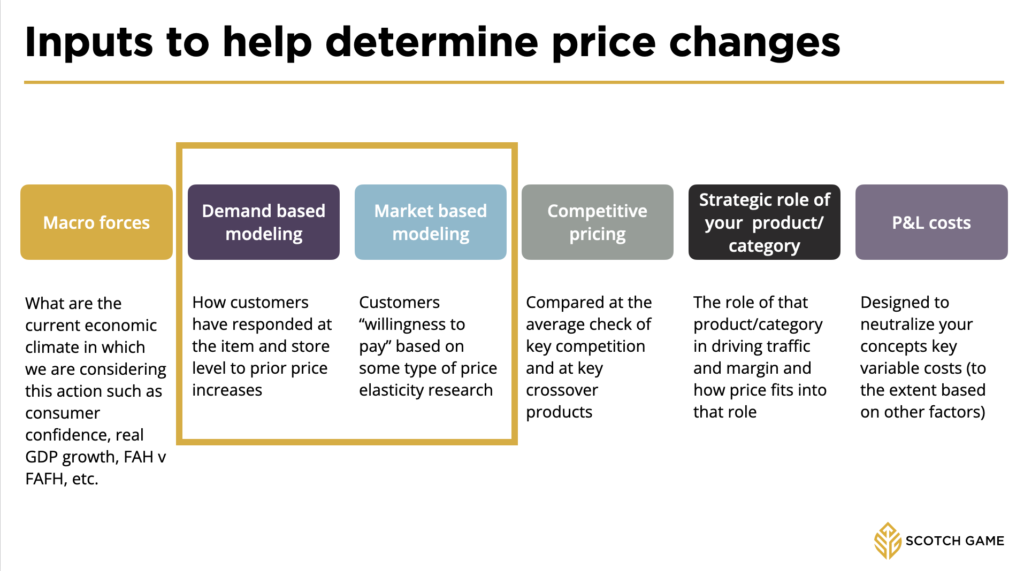

I have a couple of thoughts, first on integrating competitive pricing into decisions around where to take a price on your existing menu and, second, how to get the voice of the person paying the bills into existing menu pricing decisions.

There are two places to introduce and understand competitive pricing:

Cross-shopped / readily understood

- Identify heavily cross-shopped items or where the market value is easily and readily understood. Use price here to demonstrate your relative affordability or the premium nature of your concept, given your authority.

The role of the product/category

- Understand the role of that product/category in driving traffic and margin and how price fits into that role—then decide if/how to respond competitively. For example, you may have line-priced a category to promote affordability at a given daypart. While the competition would suggest that you raise your prices, you may choose to keep pricing lower to signal affordability (and then price other parts of the menu higher to offset the margin hit).

I am going back to my comment about who is paying the bills. What are you doing to integrate the customer into your price increases? Typical options might include:

Pre-testing

- Take a group of stores and introduce your new prices to understand the impact on traffic and mix shifts.

Using attitudinal data to inform

- Watch attitudinal measures around value for the money, likelihood to return, intent to use, etc., as these often link to traffic and can be a bellwether.

Sample

- Get a large enough long enough sample. Remember, most of your customers are “light” buyers. You will need to watch your financials and attitudinal measures over an extended period (ideally against a control set) to understand what impact your choices are having.

Integrating this type of additional information should help you make decisions about how to maintain (or improve) your percent dollar margin delivered over the longer term.